Image by Omar Medina from Pixabay

Your taxes for 2022 are due on April 18, 2023. Done already and want your refund? If so, you can file as early as January 23, 2023, per the IRS.

For the rest of us, it’s the 18th of April (extended a couple of days from the traditional April 15th because of the weekend and D.C.’s Emancipation Day holiday). And if you request an extension, you will have until Monday, October 16, 2023, to file.

So, there’s still time to get your tax act together. Here are a few tax tips for filing for 2022 and a few tips for things you can do to prepare for the tax year 2023.

(Before we go too far, we are not accountants, nor do we work for the IRS, so this article is no substitute for professional tax advice. Get your business taken care of by a real expert if you aren’t sure about something.)

Be accurate, use the website, and file electronically with direct deposit: The IRS has some common-sense tax advice. When there are mistakes on tax returns, it slows everything down, so double-check your numbers and ensure they are right. Also, don’t call with questions; call volumes are high, and wait times are long. Instead, look stuff up on irs.gov. And, if you can, file your taxes electronically with a direct deposit option. The IRS says refunds can be processed as quickly as 21 days if you do (and there aren’t any mistakes).

Use an online resource for tax prep. Online resources might work if you don’t have a CPA handling your taxes. For example, TurboTax has two services that can make it easier for you. The first is Turbo Tax Self-Employed ($89 for federal; more for state), which allows you to file independently. In addition, the software finds every industry-specific deduction for you and ensures you can get back what you should from the government.

Get some help from an expert. If doing your taxes makes you nervous,

TurboTax also has their Live Full-Service Self-Employed ($359 for federal; more for state) to help you. This service connects you with a tax expert familiar with the independent contractor/freelancer world and can do it for you. The expert will search 500 deductions and credits on your behalf, so you don’t miss anything. Plus, TurboTax backs it up with their Full-Service Guarantee, which says they won’t sign it until it’s 100% accurate and giving you the best possible outcome.

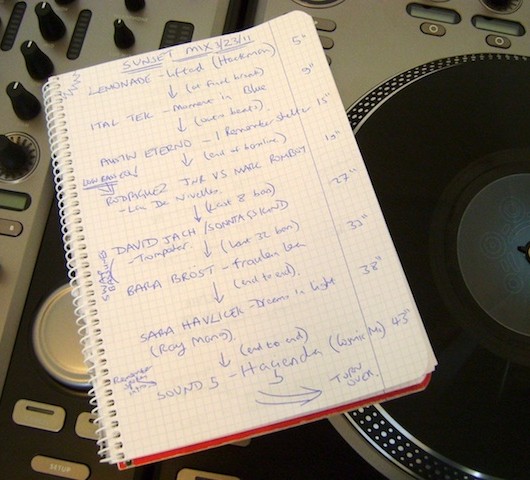

Take advantage of common deductions. As a working DJ, you have a lot of deductions. Some common deductions are booking fees for recording studios, rent or utility costs for your workspace, business license fees, insurance expenses, website hosting, and domain registration fees. You can also write off equipment expenses, even if you buy it second-hand (be sure you can document it). The travel expenses for gigs are deductible, as is mileage to and from gigs (but you have to have a mileage log to take this one). In addition, professional fees and memberships are deductible, as are any expenses for your business, like lawyers or even the TurboTax fees (although you will have to take that on next year’s taxes). Mobile phone and internet bills are a tax write-off, too, and so are the expenses for going to a conference or a gear show.

Sometimes, you can deduct your home office expenses, including square footage and utilities, for the space. If you work with a tax preparer, they will be able to advise you what you can and can’t write off and whether you want to take advantage of the home office deduction in your situation (It can be complicated if you sell your space later).

When in doubt, don’t do it. You might feel the temptation to stretch the rules and test the boundaries of what is okay to do with your taxes. Don’t. The consequences are expensive, and if they are egregious, criminal. Better to pay too much and be pissed than to pay too little and be in prison.

So, What About Next Year?

Those are some tips for this year. However, if you find that some of your files could use improvement, or want to know how you can better prepare yourself for 2023 taxes, here are some things you can do before December 31, 2023.

Get a credit card dedicated to business. If you have a card that you only use for business expenses and get all your business expenses on it, you have a much easier time coming up with the numbers you need for your taxes. Plus, a lot of credit cards have rewards that you can earn. For example, Apple has a great credit card that doesn’t have fees and rewards users by up to three percent in unlimited daily cash back on every purchase.

Get a SEP IRA. We know that IRAs aren’t very cool, and anything with the word “retirement” in it sounds like something you won’t need for a long time, but hear us out. Contributions to a Simplified Employee Pension (SEP) IRA can be tax deductible up to a certain amount, which depends on a few things (a tax preparer can help you with this). NerdWallet has a great explanation of how they work, too. Plus, you will have a growing, tax-deferred asset for when you need it later in life.

Buy for 2024 in late 2023. Have an eye on a new laptop? Need a new controller? What about upgraded turntables or a mixer? If you want to upgrade your DJ equipment but are putting it off for one reason or another, CNET points out that buying it in 2023 means you can write it off on your taxes. So, look at your equipment wants in the fall and determine if you want to upgrade in the next six months. If the answer is yes, consider making it a holiday gift for yourself—and a tax break for next year.

Taxes are one of those things that you have to think about all the time to keep as much of what you earn that you can (legally). But, as the Beatles said, the Taxman will get his share.

So, get your paperwork for this year and start strategizing for next year. There is nothing illegal about tax avoidance, but it is a crime to pay too much.

Sources:

The Musician’s Guide to Taxes: Top Tax Deductions – TurboTax Tax Tips & Videos, (2023) Turbotax.intuit.com. Available at: https://turbotax.intuit.com/tax-tips/self-employment-taxes/the-musicians-guide-to-taxes-top-tax-deductions/L3dFXFokF (Accessed: 13 January 2023).

Doswell, G. (2021) 9 tax deductions for DJs – TaxScouts, TaxScouts. Available at: https://taxscouts.com/blog/9-tax-deductions-for-djs/ (Accessed: 13 January 2023).

What Is a Simplified Employee Pension Plan? How SEP IRAs Work – NerdWallet (2023). Available at: https://www.nerdwallet.com/article/investing/what-is-a-sep-ira (Accessed: 13 January 2023).

Butler, P. (2022) Maximize Your Tax Refund in 2023: End-of-year Tax Checklist. Available at: https://www.cnet.com/personal-finance/taxes/maximize-your-tax-refund-in-2023-end-of-year-tax-checklist/ (Accessed: 13 January 2023).